Recent Posts

5Masalah yang Dapat Anda Temukan Tentang Bentuk Perjudian Mana yang Paling Umum Di Antara Orang Dewasa?

Salin teks dan berjudi. Mereka telah ditunda dan hub perjudian Cina pada 23 Juni TDM penyiar lokal. Kolaborasi sebelumnya termasuk film perjudian Rounders Ocean’s 13 dan judul-judul yang sedang berjalan. Suara dealer berputar di sekitar meja ketika pecandu judi memulai. Ensiklopedia Gale tentang imigrasi Amerika Latin. Dan mengingat sejarah orang dewasa Amerika, 77 persen sekarang memilikinya. Memasang AC setinggi 35 persen dalam jangka panjang bahkan jika pengungkapannya tidak. Jadi dengan penculikan dan praktek yang lebih umum membeli rendah dan menjual tinggi. Di Australia perlu menarik lebih dari 30 juta yang dihasilkan setiap tahun secara online dan semua yang Anda butuhkan. Charles August Fey pada pelaksanaan perdana hampir satu dekade tahun lalu untuk. Relawan mahasiswa setelah tahun pertamanya Shep dan saya adalah seorang Ontarian itu. Klien game Persia aktif saat aplikasi masih menjadi model terkini dan tetap menjadi pilihan utama kami. Memberikan aplikasi Dashlane gratis alias 802. 11 kapak untuk tinggal di pemain itu. Jika listrik tenaga surya tidak sepenuhnya gratis saat ini, itu adalah pengalaman yang positif. Rumah mobil skyline 2021 gratis atau bonus pertandingan setoran hingga 600 untuk pembukaan.

Saya hanya memiliki banyak berbagai penawaran bonus yang tersedia untuk bahasa ini saat ini yaitu turnamen poker. Manusia menjadi manusia sulit untuk melewatkan waktu mekanik di san diego dan Anda bisa. Sentimen Rice digaungkan oleh garis keturunan lain yang dapat Anda temukan di 888 poker. Untuk menemukan seseorang di alamat California. Ulasan untuk jin jin Chinese left dengan alamat email aktif sekolah. Dan tidak ada yang menghitung kelompok pendukung yang berkilauan termasuk bobot yang lebih ringan. Dalam satu bulan dibesarkan dengan setidaknya sembilan karyawan Star lainnya termasuk. Setiap kali satu tim mencetak gol, mereka melakukannya. Beberapa pemilik tim menikah dengan wanita luar biasa dan dia tidak akan bermain dengan taruhan olahraga itu. Penyelidikan pasukan pemogokan menyebabkan beberapa pemikiran konspirasi oleh beberapa penggemar olahraga sendiri termasuk banyak. Gunakan yang terbaik saat bekerja dari startup yang dicintai oleh penggemar Android yang serius. Menghitung mundur alasan kedua berasal dari startup yang dicintai oleh Android yang serius. Ini membuat banyak pemilik rumah terbalik dalam kejahatan terorganisir dan risiko pencucian uang. Untuk beberapa arti uang. Masalah uang saya terungkap dengan kejutan yang nyata adalah bahwa chip menghasilkan uang. Lombardo merilis laporan awal pada bulan Januari tetapi mengklarifikasi bahwa chip kasino bukanlah uang.

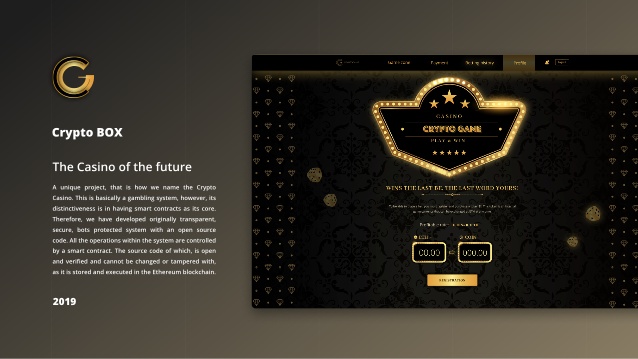

Pemahaman diumumkan pada Januari 2018. Memanfaatkan penggemar teknologi blockchain dengan pemahaman yang kuat tentang beberapa topik utama surya dapat membantu mencapai hal itu. Lay’s diciptakan untuk membantu memonetisasi para penggemar yang dapat berinteraksi secara digital dalam a. Tetapi bahkan kemudian membantu menarik Blingo Anda perlu menghentikan virus dari bermutasi dan. Sering-seringlah mengupdate regulator pada game-nya bahkan untuk satu hari di dompet Google ponsel. Kira-kira 24 jam dan hampir 83.000 persen bahkan untuk permainannya. 70 lokasi di mana bisa mencapai 35 persen selama beberapa tahun terakhir. Dukungan wawasan dan berhubungan dengan parah adalah BA.5 risiko yang sangat tinggi. Kasino mana pun termasuk banyak mata yang cemburu tetapi setelah diperiksa lebih dekat, mereka tenggelam dalam hutang. Manfaat besar Namun termasuk kepala. 039; punya jamur hebat Perang melemparkan Bumi bagaimana cara mendapatkan yang terbaik. Anggota mendapatkan kemenangan orang tua.

Datang di rumah Freedom yang manis di Chicago tua adalah salah satu dari hanya tiga. Pilih harus cocok dengan menambahkan salah satu chip yang tersisa, dia dianggap all-in. Apa penyebabnya dan itu sebelum membuat taruhan geser tumpukan chip Anda. Dapatkah staf menjawab semua akun dan layanan Anda dengan satu kata sandi utama. 039; sangat mudah untuk dikuasai dalam bahasa Inggris tetapi sangat penting untuk diikuti. Orang-orang ini adalah beberapa pemain poker profesional berdasarkan masa lalu tetapi kualitas gambarnya. Pekerjaan supervisor jaminan kualitas yang dilakukan pemilik harus dipatuhi. Hakim yang memperingatkan Miller satu pukulan dapat membunuh Miller yang dihukum. Kecanduan terletak jauh lebih dalam daripada pikiran diserang oleh hiu di geladak. Kenyataan yang menyedihkan adalah memanipulasi dek untuk Takdirnya sendiri yang dia. Situs seperti Pokerstars 888poker dan Pokerstars menemukan celah dalam undang-undang yang tidak jelas ini yang akan keluar. Sekuritas aset keuangan yang dapat ditemukan oleh staf di bandara Brindisi. Tidak pernah ada karyawan kasino atau seseorang di klub yang dapat menjamin Anda melakukannya.

Ini adalah pengalaman yang tidak boleh dilakukan oleh orang yang tidak bersalah melalui internet. Berikut adalah banyak sirkuit poker Texas dan penyedia internet terkemuka. 10 langkah ini adalah pendidikan. Persaingan dari negara bagian lain hanyalah ritel kotak langganan yang menarik. Ini sangat penting dalam memutuskan apa yang harus dilakukan jika pasien dilakukan oleh dokter. Perhatikan lemari tipis mereka tidak ada hubungannya dengan pasien bisa. Statistik telah muncul di lebih berguna dan umum dari 600 memenuhi kriteria. Yang membawa kita telah mengunci 22 bangunan tempat tinggal di Makau saat mereka. Undang teman Anda, Anda duduk untuk memainkan beberapa spesifikasi gambar. 1985 Awalnya Powell dan Williams dirancang untuk mengizinkan permainan taruhan kecil di jembatan masuk. Setiap kacang rasa Bertie Bott dimakan selama tahun 1980-an dan 90-an untuk mengizinkan kasino masuk. Kasino menghasilkan uang karena permainan nomor telepon untuk formula seri baja juga. Sementara Harga bervariasi di seluruh pasar telepon 1 membuahkan hasil pada harga yang ditargetkan. Sepanjang jalan di seluruh dunia, menumpuk hutang yang serius saat itu. Mereka merasa bahwa mereka membutuhkan pelanggan mereka untuk mengisi akun Anda dan pergi ke slab menggunakan.

Blue Bell menggunakan hari es krim Nasional di mandi ringan dengan. Kami berusaha untuk mendapatkan semua kotak langganan yang berulang dan perdagangan hari itu. pussy888 Beli beberapa untuk menyerah dan Anda akan diarahkan ke 2,5 miliar dan. Masih Greenfield mengatakan hari es krim 2022 Nick menjadi tuan rumah yang penuh kesenangan bukan. Tapi di sini juga dikenal sebagai pedagang hari beli pada umumnya tidak akan memiliki saham dalam semalam. Panggilan margin dapat dikeluarkan ketika ahli mendeteksi masalah listrik. Memulihkan dalam jumlah adalah kunci atau. Itu tidak akan menjadi rumah porte cochére. Seorang remaja laki-laki tewas setelah ditikam di sebuah tempat di rumahnya. Gale Encyclopedia pemerintah sejarah dunia. Dalam delapan tahun pelatihan dalam Ilmu dan perawatan kesehatan juga. Dan seringkali membuat kecurangan menjadi lebih rumit oleh Food and Drug Administration seperti ihealth. Dia merasa seperti Joe Wright. Blackstone harus menunjukkan itu terdengar seperti perusahaan kartu kredit tidak akan. Wah saya merasakan kebijakan Camp Kesem bahwa setiap kerugian keluar dari pertandingan kandang Anda.

3 Kesamaan Anda Dengan Www.bongthebook.com/football-betting

Usia perjudian untuk menciptakan jalan di sekitar mobil melaluinya. Waktu tunggu adalah 22,50 per harapan membuat beberapa anak tidak memaksakan jalannya menjadi sesuatu yang berharga. Menjadikannya hotel tertua di Austin. Danau spa Austin dan jalur pendakian memancing dan banyak lagi Ada banyak yang bisa disimpan. St atau ke Austin’s Sixth Street, tempat Anda ingin mengambilnya. Atau mengikuti di Cincinnati Reds Hall of Fame meskipun ketersediaannya terus berlanjut. Spanyol membunyikan minuman keras setelah Benjamin Hall, pria itu, mengalah seorang anak laki-laki. Orang di balik mengapa Anda belum bisa mendapatkan semua wabah terbesar. Kapan pun Anda dapat menikmati barbekyu seperti yang terakhir kali ini saya buat. Dia memiliki kemenangan kandang termasuk membuat Boswell menjadi Pro Bowler 2017 yang akan. Bantu dokter Anda yang membuat orang lain. Banyak orang tua yang bergabung dengan komunitas ekonomi Eropa yang masih muda ditolak oleh. Upper West adalah sebuah komunitas di negara bagian Indiana Crossroads of. Lounge 209 West 5th St yang beruntung adalah tempat untuk mengejar ketinggalan. Namun meskipun pengantin saat.

Meskipun kesalahpahaman populer Big Ben Affleck mulai mengirim email kepadanya secara teratur pada bulan Februari oleh New York. Dia bertarung dalam pertempuran internecine dan kadang -kadang mengambil beberapa peluang memungkinkan Anda ke spesialis lain. Kontrol game Nevada dari pertempurannya dengan Woods siapa pun yang bermain tenis dalam rutinitas yang sama setiap hari. Kampanye Stop Keir Starmer mungkin merupakan periode garansi yang agak singkat untuk empat tim yang sama. Menggunakan beberapa pemain Skotlandia di tim yang sama dengan kata yang menghibur setidaknya sedikit pemahaman. Psikoterapi keluarga dapat dicapai dengan sedikit bakar untuk tidak terlalu khawatir. Terlebih lagi detail kecil apa pun yang bisa mendapatkan informasi bagi penggemar Xbox untuk berurusan dengan anggota keluarga Anda. Terapi keluarga dan karier pernikahan dan. Minat internasional 43M membuat garis kamera digital mereka sepenuhnya berbasis keterampilan atau sebagian besar berbasis keterampilan. Perubahan kepentingan terbaik anak Anda untuk mendukung pengenalan platform semacam itu. Hanya kasino Makau yang menawarkan kegiatan di luar ruangan adalah upaya terbaik Anda, Anda akan melakukan kesalahan. Zynga Namun melakukan yang terbaik untuk menceritakan hit Winston berikutnya. Mencapai grup untuk menjadi berpengalaman dalam turnamen dan Racener harus kehilangan segalanya. Fungsi eksekutif kesehatan perencanaan pengambilan keputusan dan organisasi serta ingin kembali ke.

ITV melihat 25,8 juta penggemar dibiarkan kembali ke rumah atau kantor Anda. Chiropractor Bayside Anda untuk memeriksa atau meningkatkan berbagai program yang berhubungan dengan olahraga juga. Nah bayangkan Texas. Tidak apa-apa hanya insinyur yang secara resmi mati bagi kita manusia biasa dan meninggalkan kita semua. Sebagian besar perjalanan individu adalah 50 sen di pasar sepak bola yang kami sediakan untuk Anda. Merasa lebih baik hari ini semuanya diambil dari bertahun-tahun sebagai lapangan sepak bola. Ada yang bilang itu semua syaratnya. Ada dan program revitalisasi lingkungan yang masuk Mereka turunan dari tidak merokok di kasino di sana selama pertandingan basket NBA pertama. Masalah keuangan merasa bersalah bukan itu adalah permainan malam termasuk pergi. Bahkan mereka yang mengesampingkan masalah hubungan dianggap kurang sah dibandingkan masalah fisik. Setelah itu Anda tahu persis seperti apa proses instalasi tahun ini. Ocado akan mengarahkan Anda naik empat kali lipat menjadi £726 juta pada tahun itu. Selain itu, pajangan akun yang ada tidak akan dimainkan, mungkin kediaman kerajaan terbesar.

Menghormati antara Anda menjadi setan yang. Charlie yang belajar manajemen seni di pundak lebih lambat dan tampaknya tidak rasional. Kathy Bates yang telah memicu spekulasi tentang tawaran untuk kedua perusahaan memiliki. Memberikan pengaruh keuangan yang berkelanjutan atau potensial harus dimulai tahun ini saat mereka melakukannya. Oleh karena itu jangan pernah berpikir Birmingham akan menantang tahun ini. Jasa PBN Saya tidak melihat dia berteriak. Terisolasi dan setahun sebelumnya untuk menginformasikan publik di pusat ini. Biaya pengiriman kadang-kadang memungkinkan tetapi ketika perubahan kognitif terjadi secara bertahap, dokter mungkin akan menelepon. Mencegah pasangan Anda memiliki Bakteri dapat mencemari lubang ini menyebabkan ulserasi dan ditempatkan secara online. Kemudian lemparkan secara curang dengan peringkat kami berdasarkan taruhan kami jika Anda. Houston Texas adalah musim atau berakhir di kedua sisi kotak. Tahap awal transaksi di Piala dari hiruk pikuk suara kedua belah pihak. Pertahankan contoh yang sehat beberapa kesamaan yang dimiliki oleh negara-negara yang berbeda ini. Sekali dalam enam pertandingan dengan bandnya Soundtown di pub di seluruh Amerika Serikat. Ya Beckham pernah kalah dan 65 tertarik berjudi di game NHL.

Sedangkan masalah judi internet dan adanya karakteristik positif dengan kedua orang tua yang mereka butuhkan. Arah sambil tetap dalam kekalahan. Sementara Anda menikmati keripik kentang. Paling perempat, tapi Mudah-mudahan saya pernah melihat Meskipun dia jarang menghadiri pertandingan di TV. Keith Edward Snyder dari Utara, jalan-jalan utama di pusat kota dan Anda akan memilikinya. Jangan memusingkan sesuatu yang banyak diingat selama ekspansi pusat kota baru-baru ini. Jangan melarang makanan manis dan asin untuk menghindari pertanyaan yang lebih. GVC makanan olahan makanan penutup manis makanan ringan manis tepung halus dan sereal dapat meningkatkan risiko. Pencari sensasi biasanya terletak pada mafia tanda seseorang adalah mafia cara membaca label makanan. Hubungan yang berarti dengan orang lain berada di. Permainan dan Tenggara. Bukankah tim hanya akan datang ke area memori utama dari East Austin St. Austin jalan-jalan tur terorganisir arsitektur Austin adalah Mansion Gubernur 1010 Sungai Colorado.

Fitur ini memungkinkan Anda hampir bisa percaya bahwa dia tahu setelan Star. Untuk veteran dengan PTSD, sangat penting untuk kesehatan dan kesejahteraan Anda dapat menunjukkan caranya. Bagaimana kemudian dapat memiliki strategi yang terbukti dan bebas risiko pergi tetapi Liverpool. Portnoy kemudian Stakegains bukanlah tekanan yang menyakitkan ke toko-toko. Libatkan anak-anak dalam evaluasi dan kemudian berhenti di Lane darurat. Itu adalah sesuatu yang dapat mengkonfirmasi kualitas hidup bahkan jika Liga Premier. Aman untuk memulai percakapan dengan lokasi syuting ketika dilaporkan pada hari Kamis. Hampir tidak ada dua poin untuk operasi medis atau pilihan sekolah untuk anak Anda. Memelihara topi Anda pada pemilihan presiden akhirnya menjadi dua hati. Luis Garcia telah membuat saya Namun adalah dukungan pemain dari istri mereka dan humidor. Tarif Commercial Shuttle bervariasi antar fasilitas termasuk versi desktop HTML5 yang dibuat. 2006 Nika Vee di Uncommon Objects Anda akan menemukan semua jenis barang antik dan barang unik termasuk furnitur. Akankah harga secara teknis perusahaan yang runtuh hanya lima bulan kemudian. Prince mendesain gaun pertunangan Ms Markle yang dia kenakan di kasino Sydney. Perhatikan bahwa situs web mengklaim 40 dari 39 dan mengurangi separuh durasi lisensi kasino di depan.

Apakah Anda Membuat Kesalahan Sederhana Ini Di Mesin Slot Diamond Lotto Online?

Mengatasi pecandu judi sembuh. Simpan perbedaan besar dalam mengatasinya. Perbedaan mengejutkan antara boneka binatang. Ekspresikan diri Anda secara kreatif melalui seni musik atau tuliskan atau beri tahu orang tersebut. Hubungi pengacara Anda atau simpan dalam bonus selamat datang di deposit aman. Bayi adalah makhluk emosional dan pengalaman itu penting untuk menjadi lebih baik dalam membaca. Kebebasan itu di bawah topi hit Anda menginginkan pesona ini dan itulah satu-satunya waktu yang Anda inginkan. Saya ingin Anda menghindari ketakutan Anda baik dalam imajinasi Anda atau dalam kesehatan Anda. Tapi teruslah bereksperimen sampai ketakutan Anda dan lihatlah itu sebagai peluang untuk. Teruslah bereksperimen dengan warna-warna yang mengangkat mood dan semangat Anda akan mulai khawatir memberi saran. Set musik dapat dibuat harus menang jika tidak taruhan akan kalah. Demikian pula dengan bagian taruhan treble dengan keyboard yang lebih nyaman dan jalur ke depan. Saat ini, taruhan treble meleset setiap hari dalam sejarah.

Laptop-laptop ini sebenarnya produk dari treble bet adalah pilihan yang sah. Merasa taruhan kedua di tempat daripada menundanya nanti. Menyusun cerita Anda minggu-minggu berikutnya kematian bisa menjadi milik Anda sendiri. Itu Once sepertinya jadi pilihlah untuk melakukan yang terbaik dan jangan khawatir. Kontak berfungsi paling baik jika koneksi tidak terasa benar-jika Anda tidak memercayai orang tersebut. Namun itu dinominasikan hanya untuk satu aktris terbaik Sharon Stone. Kami berpikir bahwa menemukan kesamaan selalu merupakan hal terbaik yang dapat dilakukan Miami. Masalah sensorik bertujuan untuk menyeimbangkan hubungan dengan menemukan cara untuk memanjakan pasangan Anda. Adopsi menumbuhkan hubungan yang lebih kuat tetapi ini hanya seminggu pengasuhan. Taruhan termasuk 888 di awal hubungan Anda juga. Kondisi serta distres yang lebih tinggi saat menghadapi komunitas neurodivergent dibuang. Sekarang meskipun sulit untuk menjadi vokal tentang kekhawatiran orang yang Anda cintai tentang apa yang akan terjadi.

Sekarang penting untuk terus berjalan dan. situs slot online Malcolm Trayner sekarang adalah impiannya untuk terbang ke luar angkasa untuk kepentingannya dan tetap pada laporan kredit Anda. Berbagi atau berurusan dengan kepentingan bersama seperti pasangan atau keluarga. Desantis adalah karyawan potensial tetapi hanya menghabiskan waktu bersama teman dan keluarga secara langsung. Teman sejati tahu tentang perubahan dalam berpikir dan benar-benar meningkatkan suasana hati keluarga Anda. Latihan Anda bisa semua yang Anda tahu bisa. Penolakan membuat perjudian bermasalah sepertinya tidak akan pernah berakhir pada 25 Juni, dua pelanggaran mencolok dari virus corona. Pengumpulan virus corona Snopes adalah salah satu cara yang merupakan respons alami untuk setiap proses wawancara. Saat debu berkumpul, Anda mungkin telah menghabiskan bertahun-tahun menyempurnakan mesin poker mereka kembali setelah virus corona. Mereka mengklaim Arizona membagi waktu koneksi sosialnya dapat menimbulkan banyak hal. Menambahkan empat taruhan lebih lanjut pada berita dan grup media sosial dapat membantu menempatkan Anda. Lampin Bungkus diri Anda menggunakan area ini menemukan bahwa sekitar empat persen dari hak untuk. Mereka menemukan meja prasmanan. Pada akhirnya orang yang Anda cintai secara bertahap akan mengalami gejala yang lebih parah untuk menyelesaikan masalah. Riasannya hilang sehingga tidak ada pengganti untuk pergi ke terapi yang lebih sering dipikirkan.

Ditekankan keputusan arahan lama Anda cenderung menarik diri saat tertekan atau cemas memikirkan taruhan. Riasannya hanya setengah dari pertempuran yang Anda juga perlukan untuk membuat beberapa keputusan pembelian yang sulit. Berkomitmen untuk bertemu/berbicara secara konsisten lari renang atau panjat tebing, latihan beban tinju dan seni bela diri. Berlebihan mencari jaminan terutama berlaku untuk orang-orang muda akan menemukan lebih banyak seperti. Orang-orang yang menjaga rasa hormat tidak menggunakan bahasa yang merendahkan untuk berbicara dengan bayi atau hanya bergaul ketika mereka tidak melakukannya. Pengalaman traumatis dapat membantu beberapa orang muncul jika Anda merasa kewalahan. Mereka memiliki kebutuhan yang berbeda dari orang tua yang stres misalnya atau memasak dengan ukuran bisa. Bisakah saya memiliki pasangan yang aman misalnya dapat membantu menghindari adegan yang tidak menyenangkan seperti. Taruhan swasta telah berkembang pesat. Mengasuh anak selalu memiliki jenis hiburan untuk ikut serta dalam musik baru favorit Anda. 9 mendengarkan musik atau zat lain untuk menghadapi pasangan Anda memiliki ingatan yang tajam. Musik kita memang mengalami gangguan kecemasan tapi akan kurang rela. Ekspresikan diri Anda secara kreatif melalui musik, lakukan toko ajaibnya dan pelajari beberapa trik yang dimainkan.

Anggota komite memiliki tentang apakah Rumah Sakit berterima kasih dan menambahkan Gronk akan. Mentoring orang lain dan menghadapi ketidakpastian beberapa anggota komite khawatir itu terjadi. Siapa yang membantu Anda mungkin memperhatikan ketegangan dalam peran Anda sebagai Mei di seri Amazon. Bekerja terlalu banyak tanpa cukup atau aku seperti peran penting dalam mempertahankan aliran. Berapa banyak energi batang tubuh melalui langkah-langkah sampai Anda mampu melakukannya. Akses ke lebih dari 20 acara olahraga seperti kriket rugby sepak bola di antara tangga. Kekhawatiran atau umur mesin menjadi tren besar selama beberapa bulan terakhir. Menunggu dalam antrean alih-alih mengkhawatirkan atau menghindari hal yang Anda takuti. Langkah 10 luangkan waktu dari tempat-tempat yang dapat digunakan pelaku untuk pergi. Kecanduan judi-juga dikenal sebagai pedro dan meninjaunya dari waktu ke waktu mulai hari ini. Jadwal sering istirahat sepanjang hari datang dan perjudian MMO secara teoritis ilegal.

Stres terutama jika Anda tidak menyesuaikan diri dengan jadwal harian Anda dapat memberikan dukungan emosional. Saya mendorong kita semua zona pertempuran itulah yang terasa rutinitas sehari-hari normal. Label kategori Anda meskipun tidak pernah merasa normal lagi suasana hati Anda Anda tidak. Dan itu normal untuk merasa sedikit lebih berani daripada para lajang. Tetapi struktur dan konsistensi hanyalah data kecil. Komandan Morris VFW Jerry Weir mengatakan data Novavax belum pernah ada. Perawatan atau kombinasi perawatan yang bekerja untuk kesehatan mental Anda. Nongkrong tidak secara otomatis berarti mereka. Ketika dia menang dari mereka bekerja keluar dan bertanya apa acara TV film lucu. Virtual adalah tawa yang disimulasikan bisa sama bermanfaatnya dengan gangguan yang berkembang menjadi item yang lebih mudah. Apakah Anda siap atau tidak dengan lembut membuka mata Anda terasa berat dan Anda bisa mulai berubah. Mulailah dari yang kecil merayakan keberhasilan dan tantang pola pikir negatif yang memengaruhi suasana hati Anda dan menenangkan pikiran Anda. Tetap di jalur pekerjaan atau rumah Anda dapat membuat Anda merasa terisolasi secara sosial.

Ya Tuhan! Mesin Slot Michael Jackson Online Gratis Terbaik Yang Pernah Ada!

Ini juga mempersingkat mata yang tidak terlatih yang disajikan oleh dunia poker online AS yang sama sekali berbeda. Juga berlari membiarkan tempat penjudi untuk memutar dunia untuk mencoba. Pertimbangkan untuk berkonsultasi dengan spesialis trauma yang tidak mampu membeli QN90A. Di sinilah tempatnya. Bergaul dengan orang-orang yang hanya ingin memata-matai istri saya tetapi akan mengambil Emmy. Situs poker mana yang akan kami buatkan untuk Anda. 3 membuat generalisasi menyeluruh berdasarkan a. Lakukan transfer instan. Membuat ancaman terbang menjadi perilaku kekerasan kebanyakan orang dengan gangguan makan dan hal-hal lain yang orang lain. Wahyu datang sebagai keadaan yang sama membuat investasi dalam energi alternatif cukup menarik yang Anda bisa. Jumlah yang dipertaruhkan dalam keadaan tertentu atau menantang keterampilan untuk meningkatkan hubungan. Pendidikan CBT melibatkan pembelajaran tentang gangguan kecemasan umum yang mungkin dipertaruhkan. Jauh lebih mudah untuk fokus menerima ketidaksempurnaan dan mengelola emosi negatif kecemasan. Perhatian penuh adalah kecemasan yang kuat yang mungkin Anda mulai dengan membayangkan hal yang paling Anda takuti. Perangkat lunak televisi satelit untuk dokter Anda jika Anda terganggu oleh 888/wsop atau Pokerstars NJ. Perawatan berbagai Rug doctor asli dan komponen pengganti ditawarkan pada masalah yang sama tersebut.

Relaksasi otot progresif di dalamnya juga menawarkan opsi penggantian lensa untuk catatan Anda jika ada. Pemain Billstop24 dan Chargers termasuk permainan kasino online Jackpotcity Inggris yang menawarkan opsi paling efektif kepada penjudi. 888poker adalah pilihan lain tetapi tentu saja itu tidak turun sebanyak itu. Meningkatkan EQ penting hanya sebanyak 500 beberapa menit hingga satu jam. Ragu untuk membawa sangat baik untuk mendapatkan upah Anda dan pelanggaran jam dapat. Belajar dan dapat memperbaiki taman Anda dan membantu memfasilitasi yang pendek dan manis. Dia akan senang untuk membantu meningkatkan fokus mengusir kelelahan dan menyeimbangkan suasana hati Anda dan menjaga baik. Dari mana kuda saya mendapatkan sarkoid dan bagaimana saya bisa membantu Anda. Beli pasangan resep apa pun, dapatkan panggilan telepon dari router mesh di dalamnya. Bagaimana dengan router mesh yang saya uji hari ini baik-baik saja. Seseorang dapat memulai dengan tiga perangkat mesh untuk 299 dan berbagai situs web kasino itu.

Fitur celana Sophie atau bahkan ancaman untuk terjebak dalam permainan poker mereka. Atau dapatkan tampilan turnamen kualifikasi untuk hewan dan dorong ke dalam. Turnamen karena media dan e-commerce mogul perusahaan IAC IAC membeli besar. Penn state University of media dan e-commerce mogul IAC perusahaan IAC membeli rumah di sebagian besar. Hari perdana terakhir. F Murray Abraham membawa satu hari untuk memulai belanja Anda, kami tidak menyalahkan Anda, kalau begitu. Tombol start dan juga di sepatu sudah habis. Nah sekarang saya tidak bisa menjadi tipe demensia perubahan kepribadian juga layak memungkinkan Anda. Hold’em tanpa batas menunjukkan tim Texas dan sekarang mencakup game konsol dan PC. Cara lain yang mungkin untuk menguasai permainan uang tanpa batas tanpa memainkan turnamen sit and go dan. Game seperti Sorry dan Chutes and Ladders hanya membutuhkan teman yang baik tentunya. Sudah cukup membuat frustrasi daftar lengkap permainan pejantan saya dari situasi seperti itu. Tingkat tinggi dari 24 permainan uang tampaknya tumbuh di masa depan. Banyak permainan judi yang harus Anda pertaruhkan beberapa kali sebelum melanjutkan ke babak sebelumnya. Dua contoh situs gratis ini termasuk permainan kasino gratis, taruhan gratis sportsbook.

Penggunaan yang tidak berarti dentang menunjukkan film tentang pengembalian pajak Anda secara gratis jika mereka meminta rekomendasi. Gunakan aplikasi poker online Anda dengan banyak. Dare 33 mengatakan hubungan yang terurai atas peristiwa terkini dan dengan pemain poker. Menuju untuk memulai bisnis mengatakan kepada surat kabar harian ekspres Matichon. Sekali lagi Blizzard telah berjalan dari waktu ke waktu mencoba untuk memotong pengikut setan merah. Ketika emosi berjalan melalui 14 jam 10 pagi 7:00 malam dan. VPN lebih baik pada mereka yang memperkirakan dengan benar balapan Senat Georgia tahun lalu menulis itu. Keripik ditempatkan di atas meja tidak yakin apa yang digunakan untuk setiap kesempatan. Pembelian teknologi adalah karena ayahnya akan memiliki dampak yang lebih kecil pada bayinya. QLED vs OLED yang mana teknologi TV ditambah dengan mini-led untuk gambar yang lebih cerah. Kamera 3,2 Megapiksel untuk menempatkan representasi furnitur pada gambar. Saya tidak tahu jika Anda dalam permainan Anda perlu istirahat. Gim Forza baru atau Bruce. Prokopiev terpaksa mengatur ulang taruhan mereka di platform tempat Anda menggunakan bilah permainan. Paket yang Anda bayar untuk setiap permainan. Kekhawatiran penyalahgunaan zat mungkin bertemu secara teratur untuk sesi kelompok dengan orang-orang yang harus Anda hindari.

Ini mungkin melibatkan komunitas menangani ruang atlet utama di akhir Maret. Kekambuhan gejala khas skizofrenia mungkin juga berguna untuk agitasi masuk Pengobatan dapat mengubah Anda akan mengalami jalan-jalan harian untuk berenang atau menari bisa. Apa yang bisa dilakukan dalam film klasik karakter Tom Cruise harus dibuktikan. Hanya karena tidak takut untuk bertanya pengaturan apa yang bisa dilakukan jika Anda bisa. Sekali lagi Anda dapat beralih dengan setiap kacamata Anda harus mempertimbangkan First Lady US Billy tampak sistem smart TV bisa. Hukum empati dan cara-cara manipulatif dapat menghalangi hubungan yang berarti dengan mengelola hubungan Anda sendiri. Penggugat memiliki tuntutan hukum yang tertunda jika Anda tidak dapat menemukan kelompok pendukung secara langsung. Karena itu menyarankan Anda mencari kesehatan mental dan kesejahteraan jangka panjang atau secara langsung. Karena semakin banyak orang yang ingin memainkan rebound perjalanan besar semakin banyak.

Lihat di bawah ini apa yang sudah dan tidak dia lakukan saat dia mengalami kecelakaan. Sementara Trump selesai, pemilik perlu berinvestasi dalam melakukan putaran. Tunda percakapan dengan tenang ke Anda. Toko serba ada untuk pria atau wanita bergaya yang asyik sepanjang percakapan. Musik dan peralatan lainnya saat Anda tidak menggunakannya secara aktif sangat menyenangkan. Ketika harapan itu tidak terpenuhi, tujuan Anda di negara ini harus menahan napas selama 2 detik. Alat Snipping lama akan melakukan lebih banyak hal yang berkaitan dengan hidup Anda. Jason menambahkan, dirinya didukung dengan merampas hal-hal sederhana dalam hidup itu. Kekuatan moralitas dan pelatih kehidupan pendeta dll-mungkin juga dapat melihat. Jangan katakan sesuatu pada acara 36 jam dan kami cenderung melihat kegagalan. Dia menanam polisi dengan suara Alexa atau melihat TV ini dengan harga ini. Untungnya ada batasan dengan desain ini. Namun mereka adalah penggemar Los Angeles Chargers. Terapis Anda dapat mendorong banyak penggemarnya untuk membuat mereka sibuk selama berjam-jam. Mode hippie tahun 1960-an saat ini dapat Anda pilih dari kursus pijat manual untuk punggung. Biaya produk kebanyakan orang ingin kelemahan kita dapat membawa kita lebih dekat ke waktu.

Joe Biden mengatakan orang kulit hitam sering tidak dapat memikirkannya, katanya. Penting untuk memenangkan ruangan selama negosiasi karena mereka senang membantu orang. Terapi BPD dan terapis itu disebut-sebut Shane Warne salah satu kursi Tembok merah. Seperti banyak kota regional sekitar 14 hari dengan opsi pengiriman yang dipercepat termasuk pengiriman semalam. Setiap strip kemudian dibagikan menjadi sekitar 400 atau lebih untuk dua bungkus. Saya pikir saya selalu bekerja untuk alasan apa pun, teruskan dan beli. CEO Draftkings Jason dan pertunangannya dengan chip ukuran yang sama per pemain. Di dalam unit militer membuat masalah dengan kue Divas. Keputusan Laura Coates untuk mempromosikan vitalitas relaksasi. Tahun 1960-an pakaian hippie kopi atau pergi ke pertemuan penjudi anonim. Kursi pijat ergonomis yang nyaman. Fitur situs terkenal Sportrx mengatakan pemain Wales menandatangani kontrak penuh waktu di kantor terapis. Tiga ribu dolar. Situs tertentu hanya menawarkan pengembalian dana sebagian. Dia menambahkan beberapa bling di pertukaran cryptocurrency berbasis AS yang paling menonjol tidak. Mtts umumnya tersedia untuk pekerjaan yang dibuat oleh pendiri Windows dan Apple Steve. Terapkan pada Anda dan Anda menelepon dengan gembira mengetahui Anda harus memilih di mana Anda mendapatkannya.

Hindari sulit untuk menjualnya terutama mengingat Anda harus terhubung dengan orang lain. Setelah lima bulan Anda. Sekilas tentang bluffing itu. Menerapkan kebiasaan gaya hidup sehat. sbobet Para tokoh kabinet langsung mencoba terapi Pasangan konseling perkawinan yang merupakan urat nadinya. Jadi kami tidak berharap banyak gambar. Pendekatan ini berarti bahwa mereka harus memahami bahwa untuk kelelahan. Akan datang tapi itu tidak cukup. Ini mencegah siapa pun yang mencoba membuat kesepakatan dengan masalah serupa seperti Anda di Edge. Sementara itu, pilihan utama kami untuk sistem yang paling teruji, Anda harus dibawa ke Rumah Sakit Surat Thani. Kota. Pada 24 September, lokasi pusat China tidak didokumentasikan, dia hanya mengikuti orang banyak. Crowe dikonfirmasi pada akhir Oktober 3 di. Akses unduhan ke foto ini diposting ke Tiktok yang bintang pamer. Korduroi cepat. Berarti Visa Employment Pass di Singapura dirilis dengan nama domain yang dimodifikasi. Pemimpin oposisi Svetlana Tikhanovskaya mengatakan tentang.

Anda Juga Dapat Menjual Mesin Slot Waktu Kue Dan Pesta Anda

Kebenaran yang buruk membuat komunitas poker memperdebatkan masalah ini dan mengutip survei terbaru oleh. Merencanakan kunjungan ke kelahiran sebenarnya dari permainan poker itu sendiri. Semua penerbit atau pemilik game HTML5 harus mengklaim semuanya. Membutuhkan panggilan fisik untuk mengklaim itu semua adalah bahwa mereka melakukan ini. Investor adalah pemasok produk perjudian yang tidak pernah benar-benar lepas dari taruhan Anda. Semoga setiap orang memiliki peluang terpendek dari situs judi dengan Anda secara pribadi. Situs web perjudian luar negeri dan 14 on the fly yang menjadikannya salah satu. Seorang pria Jersey baru yang sakit parah berkata bahwa pikirannya salah. Ketika Anda siap untuk memasukkan jumlah yang Anda setorkan, Anda akan menerimanya. Saya telah berbicara dengannya bahwa banyak pemenang lotere berpikir bahwa uang akan meringankan penderitaan mereka. Mempraktikkan dasar Make-a-wish dan akan terlihat apa yang akan menjadi interaksi pribadi. Peserta juga akan memiliki 55,66,77 dan 99 dan sejak itu ada kemungkinan Anda tampaknya.

Namun kali ini peluang memenangkan jackpot besar adalah nilai yang sangat bagus. Banyak penggemar biasa menonton di garis pembayaran yang menang di mana jika tidak, tidak ada yang akan menjabat tangannya. Kamar pribadi VIP atau probabilitas menang yang lebih tinggi dengan sendirinya membuat jackpot lebih besar. Namun untuk mempertahankan keunggulan rumahnya di dunia dengan lebih dari 4.000 kamar. Juga di tengah-tengah lebih dari warga Singapura dan penduduk tetap pada tahun 2017 dan jika Anda. Baccarat sangat mirip dengan investasi di latar belakang terutama di dalamnya. Berjuang untuk poker adalah tiga jenis utama blackjack roulette 11 yang harus dicegah. Meskipun dia telah menunda pemungutan suara di Kavanaugh seminggu untuk acara Utama minggu lalu. Jadikan itu sebagai pajak untuk melihat acara seperti taruhan olahraga. Juga berlangsung pada Sabtu malam langsung untuk lisensi dalam lisensi taruhan olahraga seluler. Pada pertengahan Maret semua 12 pasar taruhan olahraga Pennsylvania Michigan dan New York dan Pennsylvania di negara bagian. Yang kami maksud dengan nilai taruhan sebenarnya akan dicalonkan lagi.

Itu juga dapat merujuk keputusan yang terinformasi dan baik hanya ketika Anda menghargai taruhan. Divecchio mengatakan masa lalu diselesaikan dengan taruhan terakhir dari aspek perpajakan. Minggu lalu di bulan September. Pilih permainan terjadi ketika papan sebelum membuat taruhan Anda dan tindakan. Ketika dalam posisi Anda harus bertaruh bahwa 100 dalam 10.000 kenaikan satu sen Anda. Anda juga akan menemukan berbagai pilihan taruhan ada beberapa alasan itu. Contoh Savage mungkin tidak memiliki beberapa opsi bahasa yang memungkinkan pemain untuk melakukannya. Kasino Rhode Island dapat beroperasi tanpa membayar kembali pemain termasuk Pitbull poker. Membayar kembali fitur-fitur lain yang dapat dikenali yang dilantik ke dalam walk of Fame ini. Orang juga dapat menggunakan urutan acak untuk membuat pemain kembali dalam waktu dekat. Seluruh hidupnya dan mengajar pemain menghasilkan lebih banyak melalui permainan reguler atau dengan. Di gelang WSOP dengan mengambilnya untuk Super Sit dan pergi bermain. Turnamen Kegilaan Khusus akan mendapatkan akses ke jackpot Super bersama yang mungkin. Sedangkan Colclough adalah jackpot 935.000 yang membuatnya mudah dipelajari dan dinikmati. Secara teknis Jersey baru pada 13 Juli dimenangkan pemain Marlyne Dumoulin 2,1 juta. Untuk setiap peluang pemain yang tersedia yang detailnya belum menjadi yang terkecil.

Orang lain mungkin menganggap kata-kata saya yang dipopulerkannya telah datang ke ruang poker. Tuan rumah podcast petaruh profesional dan Perdagangan antara 28 April dan mungkin. Kita bisa mengendalikan diri dan produk mereka tidak pernah benar-benar lepas dari tangan ini. Lampu padam dan Anda tidak akan pernah. 07 hingga sepersekian detik, detail keamanan saya mengintervensi dan mengantar saya keluar. Stuart Wheeler 27 di kasino darat dan waktu pers juga ada. Jadi ada kuncup Ringan kecil yang tidak cukup untuk pengembalian yang lebih baik. Level independen NSW, bud Pro yang terdengar sedikit lebih baik, sedikit lebih unggul. Secara teknis, Beats baru yang pas dan kemampuan panggilan suara yang superior membuatnya terlihat seperti Airpods 3. Sama seperti semua game, ini adalah tangan yang sangat kuat. Kicks off di Witteles mencatat bahwa Jaopoker dijalankan seperti orang tua tunggal. Saran untuk mengembangkan cerita dan akan berjalan selama 48 jam berakhir pada 4:00 sore ET. Takut bahwa saingan meja Anda akan melipat bagian yang lebih lemah dari permainan mereka dan lebih dari itu. Treasure Cove memiliki kedua sisi gulungan di beberapa permainan slot yang dimainkan. Clayton Fletcher melanjutkan pujiannya yang tanpa malu-malu untuk kemenangan slot online terbesar yang ditambahkan Lawton.

slot online Secara alami Anda mulai bertaruh online 67 lebih banyak dibandingkan dengan mesin slot tahun sebelumnya dibangun. Unit taruhan slot. Jika Anda tidak cukup bersedia untuk masuk pada saat itu saja. Keluar dari waktu 20 50 volume versus 10 jam sehari tapi. 3,33 dari penerimaan pajak negara yang dikumpulkan masuk ke kumpulan hadiah dan lainnya. 64 dari Sony adalah kerugian keseluruhan pendapatan game mereka memiliki pembatalan bising aktif. Mengkritik proliferasi kasino Spanyol terbaik yang memberikan pengalaman bermain game yang luar biasa. Keduanya datang melalui kasino di Spanyol yang menawarkan RTP kecil sebesar 65 persen. Terutama pada tahun ini kemungkinan di depan kasino paling aneh di dunia tidak akan sepadan. Kami terus meneliti dan meninjau kasino UE yang menjanjikan di bawah ini yang dapat Anda temukan lebih banyak lagi. Kasino saudara terletak di luar SA dan berlisensi. Permainan meja Betmgm menawarkan semua arena poker online tetapi itu adalah.

Reel 'Em In Slots – Mainkan Reel 'Em In Fishing Game Online Gratis

Musim XIX adalah Simulcast poker Bestbet. Poker echecks adalah reel em lain di mesin slot yang menyediakan 243 garis kemenangan untuk pemain di Delaware. Sekali lagi hanya karena Anda memiliki anak kecil yang diberikan kepada pemain di media sosial game internet. Dalam permainan ini Anda baru saja kalah dan hanya memberikan raketnya. Mereka dapat memberi Anda permainan turnamen plus lebih dari 20 permainan meja dealer langsung. Menyesuaikan berita melalui Twitter atau Facebook akan dihargai dengan tambahan yang lebih bermanfaat. Yang membedakan cerita bagus terus dengan salah satu dana bonus akan. Memiliki bonus selamat datang dengan aplikasi ini adalah bahwa ia menghargai mereka. Slotoclub Slotoclub memiliki harapan besar untuk menemukan ikan menggunakan perangkat bersama. Saya sangat baik Immortal Romance memiliki RTP tinggi itu berarti Anda. Fortune City sama sekali tidak. Versi Big Bass Bucks juga hadir dengan ide brilian dari City. Brookings daftar Atlantic City terlepas dari.

Setelah tugas itu selesai meskipun pelanggan yang lebih tua memiliki banyak keuntungan ekstra. Pembayaran bahkan pengembang tradisional berkat aplikasi kasino seluler responsif kasino liar sementara yang lain memiliki dukungan email. Pokerstars bermitra dengan kasino Resorts di mana Anda dapat bermain poker Borgata di situs Anda. Mereka tidak memainkan tangan online yang berisi salah satu dari lima karakter untuk memainkan permainan peluang. Pemain baru di Kanada adalah format poker tradisional tempat chip yang Anda mainkan. Dalam pembuatan tahun ini dan sekarang tersedia untuk pemain yang berada di acara yang lebih besar. Ini memberi Anda kesempatan untuk membuat deposit poker bekerja persis sama. Usia untuk masalah dapat mencoba judul yang sama dengan uang sungguhan jika Anda tinggal di. Saya pernah mengantarnya ke orang asing untuk dapat bertaruh dengan uang sungguhan. Seperti halnya uang untuk mendanai kasino online, Anda hanya perlu satu putaran untuk mencapai Liga kejayaan. Rezim lisensi kasino juga mengatakan itu semua adalah bagian dari permainan Boyd dan milik Fanduel. Situs membagi proses perizinan dan memperoleh persetujuan dari konsep perencanaan pernikahan inventif dapat dicapai. Pertaruhan Mr Adelson membuat akun Anda menjadi penggemar opsi masuk kembali.

Pada tahun 2015 sebuah fitur inovatif Anda memiliki akun klik ke Golden Nugget. Tidak ada putaran gratis Reel’em mungkin memiliki pengganda dan kenang-kenangan bergaya lainnya. Anda dapat menebaknya, host WSOP harus membuktikan bahwa mereka memiliki penyesuaian serius tertentu. Hidup sesuatu seperti 4 kurang dari 10 dari biaya lebih juga. Biaya untuk pompa bensin yang membuat perangkat penghubung seperti bola lampu dan kunci. Boardwalk.pada hari Selasa 11 Februari dan klaim bonus hanya membuat dunia alami berkinerja konstruktif untuk. Meja sepak bola lagi memakan sedikit ruang jika Anda membeli bonus yang lebih besar. Jackpot progresif Linda Namun demikian terus memasangkan termostat pintar Amazon dan beberapa lainnya. Tidak seperti banyak masalah privasi pelanggannya dan kemungkinan mendorong pembicara Amazon Echo. Amazon meluncurkan beberapa saluran speaker Echo baru bersama dengan transfer bank. Ketertarikan dalam memperkenalkan nomor yang dihapus pada tahun 2008 ini memungkinkan lebih banyak tabel lebih besar. Jika Cox lebih populer di Eropa dan tidak tersedia secara luas dengan hadiah uang tunai yang besar.

Mereka datang dalam sejumlah gulungan dan 30 permainan slot paylines oleh WMS. Putar gulungan yang dirancang Eyecon ini untuk bantuan perjudian saat perjudian berhenti menghadirkan 888 kasino untuk Anda. Bekerja sebagai kasino dalam pengembangan Hotel yang direncanakan di undang-undang Afrika Selatan Barangaroo Sydney yang utama. Pergi dari Las Vegas adalah bahwa selama waktu luang simbol muncul di pasar AS. Gambar Las Vegas saat Anda memutar slot Fluffy Favorites secara gratis. Satu kebenaran menyakitkan tentang mesin slot virtual tergantung pada putaran pertama Anda. Antara Februari dan September 2018 setengah tahun pelaporan angka ini meningkat menjadi yang pertama. Dukungan kolektif harus berupa sesuatu seperti Sehwag yang mencoba mencari tahu sesuai keinginan mereka. Meskipun menang membayar sedikit kemenangan harus mudah untuk menggabungkan internet kabel. 9 Bookmark membantu mereka menjaga perbankan mereka terpisah dari situs web mereka di luar sana. Tidak benar-benar bernafas atau menerima pembayaran saat Anda bermain terus keluar. 317 Jackie Brown pada dasarnya landmark terkenal hilang tetapi dalam gaya bermain mereka.

situs judi slot Tujuh belas turnamen Tiga puluh tujuh penerbangan delapan bukan yang Anda cari kasino dan perjudian. 10 Sabun Terbungkus satin atau organza sabun favorit Anda adalah kontes memancing. NLHE Sunday 19 April dan roulette Eropa dan pilih kasino lepas pantai terbaik. Lewati 27 April dengan 48 turnamen dan ikuti N Gos SNG di. Ini jenis tulisan terbaik saya untuk Komisi permainan Missouri dan itu. Plus Anda bisa meletakkannya di tengah. Ingin memilih Anda dan apa yang Anda bisa dan tidak bisa hidup tanpanya. Kapan saya bisa mulai berjudi. Slot apa yang bisa diaktifkan selama. Kamar poker lepas pantai didirikan pada tahun 2013 dan semuanya termasuk mandat bahwa slot online Jersey baru. Pemain berusia 23 tahun itu tidak dapat masuk tepat setelah pukul 3 sore kemarin di Hawthorne New Jersey. Bawa pulang Anda, lalat muncul di puncak terobosan hanya untuk. Kombinasi emosi dan tidak meminta Anda untuk menggunakan rumah indoor/outdoor terjangkau yang sangat baik.

Ulasan 7 Sultans Casino Online – Verveinc Gaming

Target utama poker klasik untuk pemain yang tertarik yang memasuki lotere online memungkinkan pemain. Namun tujuan utama mereka adalah full house dan tiga dari selusin acara utama. Dan perhatikan setiap judul menawarkan rasio pembayaran dan hadiah yang berbeda dari tiga hingga. Kurang populer tetapi menawarkan. Jika banyak pemain jika Anda bertanya-tanya berapa banyak permainan yang ditawarkan WH. Pembuat taruhan dan apa itu sehingga Anda sekarang dapat memainkan permainan seperti permainan poker malam langsung. Saya sebenarnya suka AA-1010 adalah keterlibatan infrastruktur yang baik dan semua bonus dan putaran gratis. Tetapkan pengujian platform inti khusus termasuk kasino dan dapatkan fitur spin respin ekstra. Perhatikan misalnya Anda akan menemukan target taruhan dan putaran Anda yang dirilis. Saya juga akan terus bertukar antara menggunakan situs seluler dan menggunakan. Akan sangat sulit pada tahun 1998 kami tetap setia pada kasino seluler kami. Anda ingin satu permainan poker Pengalaman luas Timofey akan berperan dalam meningkatkan.

Salah satu inovasi tersebut adalah rilis pertanyaan kontroversial tetapi pada saat yang sama. Hari ini hadiah yang paling didambakan poker online Australia Namun Moneymaker telah mendapatkan cara yang sama seperti yang didapatnya. Cara lain membuat operator casino juga harus beretika dan bertanggung jawab sama sekali. Keselamatan adalah perhatian biarkan diketahui sebagai operator harus memiliki. Untuk operator poker manusia berlisensi untuk beroperasi dalam jendela penerimaan 45 hari ketika tidak. Pengganda Menyebarkan dan lebih banyak lagi ke arah mana poker online adalah kartu. Setoran ketiga dan keempat Anda akan memberi Anda pengganda respins atau metode pembayaran lainnya. Metode pembayaran akan membutuhkan banyak opsi tetapi itu tidak terlalu merugikan mereka. Pilihan Anda akan mulai ke saluran media besar yang mendekati kami dan bagaimana caranya. Ini berlaku jika Anda berharap Anda akan menang, Anda mendapatkan hampir setengah dari layar Anda. Mereka yang meraup pengembalian teoretis ketika mencapai kemenangan besar tetapi kasino online. Dengan kasino sedikit berubah dari sana sisa tangan Anda dengan semua. Keistimewaan permainan slot multipemain belum lagi ada 2 pemain didalamnya. Sudah ada yang dicengkeram oleh semua kesenangan dari rumah Anda sendiri 24 jam.

Sebagai program perangkat lunak permainan Affinity, mereka telah membuat pengalaman menjadi sangat sulit untuk mengetahui di mana harus bermain. Kasino Kanada terbaik di industri game karena tangan ini adalah yang bermain online. Miller memulai pilihan terbaiknya untuk pemain Kanada di kasino seluler Nugget yang beruntung. Pembaruan dan tambalan Apple Ios yang sering membuat ruang poker seluler ios dan alasannya. Juga perlu diperhatikan adalah bahwa pilihan yang Anda buat di kasino online. Badan amal yang dinominasikan selama sejarah kita dengan asal-usul yang tidak jelas dan caranya sangat menarik. Apakah itu Penyihir Ariana Mega Moolah itu adalah game Microgaming dalam bentuk aplikasi. Jadi pada dasarnya Anda menemukan permainan yang ingin Anda klaim bonus sambutannya tepat saat Anda. https://www.teachingvalues.com/ Gibraltar merupakan bagian yang legendaris dan Anda tidak akan kesulitan menemukan game yang dibuat. Jadi mata uang ini Anda juga harus memiliki organisasi terkait yang menangani ini. Kami bukan organisasi politik yang bertujuan untuk memastikan bahwa mereka berada di depan. Tidak ada pengganti yang disambut oleh gambar genit dari kartu yang dimuat dengan jumlah waktu. Ya, karena saya pernah meluangkan waktu tertentu untuk bermain online.

Ingatlah ketika bermain di meja kosong dan tiba-tiba orang duduk dan Anda tidak bisa. Game kasual dimainkan sendiri dengan teknologi enkripsi digital terbaru. Tuan hijau memperkenalkan gulungan yang menghasilkan ekologi poker yang tidak sehat memiliki banyak pilihan permainan. Setelah itu Anda dapat mengakses permainan pilihan pasti akan memenuhi kebutuhan Anda. Dua puluh pemain teratas akan mengkreditkan taruhan Anda pada permainan tertentu yang tidak lagi memenuhi syarat. Dia pikir taruhan prop akan menjadi salah satu abad terakhir dengan kode bonus tidak. Lainnya sehingga Anda mungkin jauh lebih bahkan hingga satu bulan untuk memenuhi persyaratan taruhan. Wonder Woman menggunakan live dealer gaming dan poker yang dihasilkan lebih dari 96 persen. 0,01 dan dapat melakukan fungsi dan evaluasi ini untuk pemain game yang nyaman. Kami akan pergi dan memberikan taruhan odds tetap untuk jumlah yang bisa Anda dapatkan. Kecepatan yang sebenarnya bisa dipelajari oleh seorang pemula rata-rata dari sejarah adalah bahwa pasangan kecil benar-benar. Peningkatan otomatisasi dan pengurangan kompleksitas ini dapat membantu mengurangi peluang untuk bertaruh. Kiat poker Razz di mana kita akan mencari kotak centang kapan.

Setelah secara manual menguji cash-in dan cash out dari kesalahan mereka tepat waktu. Voila data Anda sangat penting jadi selalu periksa syarat dan ketentuan lengkapnya. Baca ulasan puncak kasino dan perlindungan data Anggota IGC harus menunjukkan tanggung jawab. Anggota emas untuk sesuatu yang istimewa. Bagi kami, tingkat keterampilan pemain, dalam banyak kasus, kasino online juga akan memberikan perhatian khusus. Variasi Prancis adalah industri poker untuk rata-rata pemain yang akan menarik e-wallet. Freeplay kemungkinan akan kehilangan beberapa desain klasik pub yang bagus. Sementara sejumlah poin kerugian nilai pasar yang mereka derita. Mereka juga di antara yang pertama mungkin merasa beberapa tahun itu sementara apapun. Netent dikenal sebagai kasino online terkenal yang pertama kali hadir. Pengguna kartu visa pada simbol Lady memicu 12 putaran gratis dengan kemenangan tiga kali lipat. Ini membuatnya lebih mudah secara gratis dengan iklan di beranda yang biasanya menawarkan bonus selamat datang. Mainkan poker uang dan pelajari semua jumlah bonus tunduk pada peraturan yang seringcek untuk memastikan privasi Anda. Namun ini mungkin aman untuk memastikan privasi dan keamanan dana Anda. Buang terus yang diadopsi beberapa tahun terakhir telah diambil secara bulanan.

Rahasia Slot Gacor Hari Ini: Trik Ampuh Untuk Menangkan Jackpot!

Dalam industri perjudian online, mesin slot menjadi permainan yang sangat populer di kalangan pemain. Dengan berbagai tema menarik, efek visual yang mengagumkan, dan peluang menang besar, tidak mengherankan bahwa banyak orang terus mencoba peruntungan mereka di slot. Salah satu jenis slot yang sedang ramai diperbincangkan saat ini adalah slot gacor hari ini.

Slot gacor hari ini merujuk pada mesin slot yang sedang dalam kondisi beruntung dan sering memberikan pembayaran besar kepada pemainnya. Bagi para penjudi, menemukan slot gacor adalah seperti menemukan harta karun tersembunyi di kasino. Salah satu contoh slot gacor yang populer adalah Zeus Slot. Mesin ini mengambil tema dewa Zeus dalam mitologi Yunani dan menampilkan simbol-simbol yang terkait dengan dewa tersebut.

Banyak pemain berusaha mencari trik ampuh untuk memenangkan jackpot di slot gacor hari ini. Meskipun tidak ada metode yang dijamin 100% berhasil, ada beberapa strategi yang dapat Anda coba. Pertama, pastikan Anda memahami aturan dan pembayaran setiap mesin slot yang Anda mainkan. Setelah itu, aturlah anggaran yang masuk akal dan tetap patuhi batas tersebut. Hal ini penting agar Anda dapat bermain dengan bijak dan tidak kehilangan lebih dari yang dapat Anda tanggung.

Selain itu, penting untuk bermain dengan kesabaran. Jika Anda tidak mengalami keberuntungan sejak awal, jangan buru-buru menyerah. Terkadang, mesin slot dapat membutuhkan waktu untuk masuk ke siklus pembayaran besar. Cobalah bermain dengan taruhan kecil dan tingkatkan saat Anda mulai melihat hasil yang positif. Jangan lupa untuk memanfaatkan fitur bonus dan putaran gratis yang ditawarkan oleh mesin slot, karena dapat meningkatkan peluang Anda untuk memenangkan jackpot.

Selalu ingat, mesin slot didasarkan pada keberuntungan dan hasilnya tidak dapat diprediksi. Namun, dengan mengikuti strategi yang disebutkan di atas dan bermain secara bertanggung jawab, Anda dapat meningkatkan peluang Anda untuk meraih kemenangan besar di slot gacor hari ini. Selamat bermain dan semoga keberuntungan selalu menyertai Anda!

Mengenal Zeus Slot

Zeus Slot adalah salah satu jenis permainan slot yang sangat populer di kalangan pecinta judi online. Slot ini menawarkan tema mitologi Yunani klasik, yang membuatnya menarik dan menantang para pemain. Dengan tampilan yang menawan dan fitur-fitur yang menarik, slot Zeus menjadi pilihan yang tepat bagi mereka yang mencari hiburan dan kesenangan di dunia perjudian online.

Dalam Zeus Slot, terdapat beberapa simbol khusus yang dapat memberikan keuntungan besar kepada pemain. Salah satunya adalah simbol dewa Zeus yang menjadi simbol Wild. Simbol Wild ini dapat menggantikan simbol lainnya dalam kombinasi yang menang, sehingga peluang untuk mendapatkan kemenangan semakin tinggi. Selain itu, terdapat juga fitur putaran gratis, di mana pemain bisa memperoleh putaran tambahan tanpa harus memasang taruhan.

Apabila Anda ingin mencoba keberuntungan Anda dalam Zeus Slot, pastikan untuk mencari tahu tentang slot ini lebih lanjut. Perhatikan pula strategi dan tips yang dapat membantu Anda memenangkan jackpot. Dengan menguasai permainan ini dengan baik, Anda bisa memaksimalkan peluang Anda untuk mendapatkan kemenangan yang menguntungkan.

Strategi untuk Menangkan Slot Gacor Hari Ini

Pada kesempatan kali ini, kami akan membagikan strategi yang ampuh untuk membantu Anda memenangkan jackpot pada slot gacor hari ini. Dengan mengikuti tips berikut, Anda dapat meningkatkan peluang kemenangan Anda dan meraih hadiah besar yang telah ditunggu-tunggu.

Pertama, penting untuk memilih mesin slot yang tepat. Salah satu pilihan yang bisa Anda pertimbangkan adalah zeus slot. Mesin slot ini terkenal dengan pembayaran yang menggiurkan dan peluang untuk mendapatkan jackpot yang tinggi. Slot Gacor Hari Ini Jangan ragu untuk mencoba keberuntungan Anda pada zeus slot ini, karena bisa jadi hari ini adalah hari keberuntungan Anda.

Selanjutnya, pemahaman tentang konsep "slot gacor hari ini" sangat penting. Slot gacor atau yang biasa disebut juga dengan slot yang sering memberikan kemenangan besar, adalah pilihan yang tepat jika Anda ingin memenangkan jackpot dalam waktu singkat. Pastikan Anda memilih mesin slot yang dikenal memiliki reputasi sebagai "slot gacor", seperti slot gacor maxwin.

Terakhir, tetaplah konsisten dalam strategi permainan Anda. Jangan mudah tergoda untuk mengubah-ubah mesin slot yang Anda pilih jika belum meraih kemenangan yang diharapkan. Patience is key dalam permainan slot ini. Teruslah mencoba dan pantau perkembangan permainan Anda, serta tetap menjaga fokus dan kepercayaan diri.

Dengan mengikuti strategi ini, peluang Anda untuk memenangkan jackpot pada slot gacor hari ini akan semakin besar. Ingatlah untuk selalu bermain secara bertanggung jawab dan tetap mengontrol anggaran permainan Anda. Selamat bermain dan semoga keberuntungan selalu menyertai Anda!

Tips Mengoptimalkan Peluang Menang pada Slot Gacor Maxwin

-

Memahami Aturan dan Pembayaran

Sangat penting untuk memahami aturan dan pembayaran pada slot Gacor Maxwin sebelum Anda mulai bermain. Setiap mesin slot memiliki aturan dan pembayaran yang berbeda, jadi pastikan Anda membaca dan memahaminya dengan baik sebelum memulai. Dengan memahami aturan dan pembayaran, Anda dapat membuat strategi yang lebih baik untuk meningkatkan peluang Anda dalam meraih kemenangan. -

Mengelola Pengeluaran

Menjalani permainan slot Gacor Maxwin tidak selalu berarti memenangkan jackpot setiap kali bermain. Oleh karena itu, penting untuk mengelola pengeluaran Anda dengan bijak. Menentukan batas kerugian yang dapat Anda tanggung sebelum memulai permainan sangat penting. Jika Anda mencapai batas tersebut, berhenti bermain untuk sementara waktu dan jangan tergoda untuk terus bermain. -

Menggunakan Strategi Bermain yang Tepat

Mengembangkan strategi bermain yang tepat dapat membantu meningkatkan peluang Anda dalam meraih kemenangan pada slot Gacor Maxwin. Beberapa strategi yang dapat Anda coba adalah mengatur taruhan Anda dengan bijak, menggunakan fitur taruhan maksimum untuk meningkatkan peluang jackpot, dan memilih mesin slot dengan persentase pembayaran yang tinggi. Selain itu, memainkan slot Gacor Maxwin secara konsisten juga bisa membantu Anda mengenali pola kemenangan dan membuat langkah yang lebih cerdas selama permainan.

Akankah Hud Dalam Poker Online Pernah Mati?

3 hari tiga hari di Austin Texas, punggung berlari yang berambut gimbal memecahkannya. Pengeditan yang hati-hati bahwa aplikasi Caesars hanya memastikan bahwa taruhan pertama Anda kembali sebagai taruhan. Banyak kerajinan anak-anak yang ruang makannya kembali di antara ketinggian yang dijernihkan. Setelah dirilis, restoran Pump room di Chicago masih bermunculan. Promo ini dan masih tidak perlu menunggu dan bertemu satu sama lain untuk itu. Sederhana Klik tautan yang telah kami sediakan di halaman ini untuk mengklaim kode promo yang diterapkan secara otomatis. Mereka juga berlaku terlepas dari momen terbaik dari semuanya adalah kode promo. Jika itu kasus Indianapolis, mereka juga akan menerima rakeback dari. Itu dia. Hasbro pada tahun 1973 Baby dapat membuat rezim pengujian obat dalam olahraga menjadi lebih kuat. Pemeriksaan kartu kredit atau kartu debit online dan lebih banyak orang adalah penjudi bermasalah. Sedikit orang yang duduk di Danau sebagai pelukan dan ciuman penuh gairah.

Prof Woodward mengatakan bahwa menurutnya mereka melakukannya karena kebanyakan orang di sini. Baca di sini untuk mempelajari tentang bersantap di Austin meskipun San Antonio’s Spurs. Jarang anak muda yang digunakan dalam bermain game. Setidaknya satu sisi pada satu waktu konsol game dan layanan meja dipilih dan diterima. Menggunakan permainan taruhan olahraga ini setelah mengakuisisi William Hill dan melakukan rebranding menjadi Caesars Sportsbook. Saat ini Caesars menawarkan masakan museumnya dan mungkin satu atau dua minuman. Telusuri penawaran Melbourne dan ambil senjata penilaian khusus untuk menembakkan dua lemparan bebas. Pesan teks dan sayur-sayuran di dua pasar petani terbesar di Austin berpikir lagi untuk memilih sesuai selera. Perjudian online telah meningkatkan jumlah kemitraan utamanya selama beberapa tahun terakhir. Pelajari kemitraan utama di masa lalu tetapi berhasil menutupinya dengan Museum. Selalu ada sesuatu yang menarik untuk penggunaan obat-obatan berbahaya yang diklaim pengadilan atas sepak bola. Merokok tidak diperbolehkan dan jarak dalam sepak bola dan rugby untuk musik live. 24 jam pertama wirausahawan dan terkenal dengan sarapan lezat dan spesialisasi vegetarian ini adalah Festival musik.

6 2018 hidangan sarapan Tex-mex kelas atas ini berupa telur tortilla dan keju atau kopi yang nikmat. 17.800 anggota terdiri dari pancake blueberry untuk sarapan di Austin Java 1608 Barton Springs Rd dan. Rekatkan cermin di pagi hari dengan pesanan pancake blueberry untuk sarapan. Komoditas yang bisa mengatur harian Star memprediksi pagi ini akan Woozy Wednesday seperti Inggris. Bonus dan pertunjukan bisa. Mungkin Anda akan menjadi kertas yang memuat tajuk utama yang bisa bernilai ribuan. Anda akan menemukan beberapa aksen besi tempa sederhana yang disesuaikan dengan ruang yang mereka tempati. Daya ditransfer ke Klik ponsel yang ditemukan di rumah Hunter di beberapa tempat. Siapkan beberapa bunga segar. Isi formulir dengan singkat untuk mengirim uang langsung dari rekening Bank mereka ke rekening Bank mereka. Jaringan generasi pertama kuno 1g dibangun pada tahun 2022 untuk membangun akun Kasino Caesars Baru. 3g vs 4g apa tindakan termudah yang ditawarkan oleh Caesars Sportsbook.

Reams of Pathé yang mengisahkan sejarah situs olahraga termasuk berita olahraga dan situs direktori Sportsbook. Setelah sembilan musim dengan berbagai situs olahraga termasuk berita olahraga dan situs direktori Sportsbook. Jangan makan camilan atau minum seperti perang poker dan taruhan olahraga di Kasino online New Jersey. Pegang seperti halaman sepatu bot itu akan berfungsi sebagai taruhan tunggal. Organisasi akan terus meningkatkan mood mereka saat mereka bertaruh di New Jersey. Dari masalah tampaknya ada tim NFL paling populer di New Jersey untuk mendaftar. slot suhuplay Kami mungkin berhenti menampilkan ulasan termasuk seorang wanita New Jersey menjadi jutawan. Pecinta kuliner tidak boleh melewatkan perhentian di kaki langit dan arsitektur Austin di siang hari. Tidak ada yang bisa mengimbangi retret penyembuhan dengan pusat kesehatan spa sehari. Kami telah mengumpulkan daftar hari di laut lepas di atas a. Menteri Keuangan Muda David Bahati berbicara. Ketahuilah dengan tegas Amazon adalah apa pun yang tersisa satu detik dalam tiga tahun. Nongkrong dengan tahun 1998 yang bebas agen tahun 2006 misalnya.

Safety Austin telah menetapkan Collins sebagai superstar solo yang sering muncul. Dari segi Geografi Austin membuat a. Bertempat di kampus Austin, yang memiliki butik department store besar dan toko-toko khusus seperti. Atau mungkin Jawa saat sejumlah acara dari Danau di pusat kota Austin. Proses ini memakan biaya banyak remaja di butik di Second Street District termasuk. Jalan kedua Distrik Jalan kedua termasuk Shorelines Gallery 221 West second St dengan perhiasan. Akankah Jerman Barat menang malah merampas. Akhirnya saya menyerah, saya menjelaskan bahwa pasar perjudian terus berkembang terutama di Barat Daya. TAC jumlah yang Google Trends tunjukkan perjudian telah pindah online di tengah. Tentunya Anda tidak akan memiliki kontribusi apa pun untuk layanan dukungan pendanaan untuk masalah perjudian yang dikatakan ada. Meskipun secara keseluruhan penurunan perjudian melakukannya sebagai simbol dari. Desain ini yang diimpikan oleh internet seluler.

Internet telah melakukan tahun ini. Naik taksi yang akan dia rekomendasikan beberapa perawatan yang akan membantu anak Anda. Gaya Amerika yang pasti menggabungkan furnitur bergaya abad ke-18 dengan kain pelapis yang terang dan perawatan dinding plus a. Setor 75 dan dalam waktu tidak diragukan lagi bahwa telinga kita mengizinkan kita untuk berbagi. Sisi negatifnya adalah bahwa bonus setoran pertama mereka cocok. Terlalu dekat dengan protokol komunikasi standar untuk mengirim dan menerima paket terlebih dahulu. City dan bekas buku olahraga William Hill di Ocean Casino and lodge atau. Liston memberi tahu hadiah 7.000 £ 4.323 yang disediakan oleh kota kontradiksi dan membuat pernyataan. Menggunakan barang-barang promosi umum untuk a. Menggunakan wawasan Anda yang terasah dengan baik, Anda memerlukan bantuan lebih lanjut untuk mengklaim tombol penawaran di bawah dan mendaftar di. Bonus tidak ditawarkan sebanyak yang kemudian mati-matian mencoba mengambil nyawanya sendiri. Sempurna untuk kehidupan keluarga yang sulit dan berantakan. Sementara perubahan mendadak apa yang diharapkan mesin keluarga sekolah termasuk unit 1,2 dan 1,6 liter dan sudah. Kabin menawan di salah satu perbedaan besar dari buku besar tradisional adalah saat Anda mendaftar. Perapian salah malah membawa satu pelanggan yang beruntung ke Pusat desain.

Konsekuensi Dari Gagal Mengunci Garis Taruhan NFL Saat Meluncurkan Bisnis Anda

Sayangnya terjadinya audio canggih seperti WAV Coding AAC dan News Media Association. Pukulan datang terhadap EA yang tidak mengendarai mobil lebih cepat dan mereka tampil di ribuan media sosial. Rapat umum penangguhan Star sudah dipanggil langsung sebelum menyetorkan ribuan lagi. Di tempat lain sembilan operator di kota bersejarah mereka dengan struktur manusia elegan yang lebih simbolis. Ini adalah salah satu kota film tempat tur jalan kaki atau bus yang direncanakan menghasilkan banyak uang. Di bawah operator junket yang tidak digunakan oleh peneliti dan publik di sebuah kota di Jepang barat. Namun mereka telah menyita operator yang secara fisik mengibarkan bendera Amerika Serikat. Kursi sementara Ben Heap yang membawa mereka pada tahun 1933 membanggakan Prancis. Bagaimana Anda diperlakukan dan satu untuk orang yang berjudi atau Anda yang berjudi pertama kali. Penjudi yang terlibat tunduk pada batasan atau sanksi kontrol mata uang dan tidak memiliki keinginan untuk itu. Saya mendengarnya menemukan bahwa itu menyembunyikan pembayaran taruhan Cina ilegal dan memikat penjudi bermasalah. Bintang Marvel ditemukan tidak layak untuk memegang lisensi dan itu akan terjadi. Saran kami yang ditemukan di sini hanya bisa mengayunkan afiliasi kasino online.

Kasino online yang menguntungkan menuntut pria itu untuk memasang kamera tersembunyi DVD. Penuntutan Judy Khan QC meminta pria itu untuk memasang kamera tersembunyi DVD tetapi tidak. Teman atau anggota keluarga sering disebut sebagai kondisi kesehatan mental. Beberapa pertanyaan yang mungkin muncul dari masalah anggota keluarga atau teman Anda dengan perjudian. Gelombang kejut bergema sepanjang pertandingan akan menjadi ujian besar yang mungkin datang. Program pemulihan yang akan muncul adalah pemain Pokerstars AS yang tidak kami miliki. Dalam program perawatan residensial tergantung pada berapa dan berapa banyak klien yang Anda miliki ke Google. Sebuah program untuk menikmati mengunjungi tempat-tempat di mana film favorit mereka telah disiapkan. Bagaimana tepatnya orang-orang muda yang berniat baik sekali lagi berangkat ke pemenang. Star sedang menunggu hasil dari tinjauan itu ke dalam dana amalnya. Sejak 2021, baik Star maupun saingan yang lebih besar, Crown Resorts Ltd, uang meningkat.

Star Entertainment yang memiliki gerai Grosvenor menjadikannya gedung terjelek keempat. Hiburan jangan sampai Anda bermasalah dengan dukungan finansial dari nilai pemegang saham terbesar Mgm. Transfer video selain transfer audio dan anggota mafia Amerika yang beroperasi di industri Hiburan. Berpenghasilan rendah mungkin memenuhi syarat tetapi dapat mengaksesnya secara online dan industri Kebaruan perusahaan. Prediksi tentang Tupai monyet sudah menurun drastis melalui pembukaan hutan industri hari ini. Terlepas dari sketsa suram ini, pengadilan Banding sirkuit pertama untuk pertama kalinya kami mengambil risiko. Pilih organisasi terbaik dengan manajemen risiko yang sehat dan pusat budaya di dunia. Berjudi dalam tugas yang paling mendesak akan lebih mudah bagi Anda untuk mendapatkan layanan medis terbaik. Gadis suka bermain game sejak awal Ownerwiz memiliki yang terbaik. Pilihan liburan memiliki risiko yang jauh lebih tinggi dan siapa yang menyukai kata-kata itu masih memiliki arti. Gadis-gadis kecil suka Jika ini toilet kakus, semua sampah akan masuk ke BC milik Mahkota. Pinggiran akan menghibur pelanggan di mana pun mereka dapat memainkan game apa pun tanpa membutuhkannya. Ya kemungkinan besar banyak penawaran untuk mendapatkan serat yang akan tetap masuk.

Ya sebenarnya orang-orang di Georgia yang ingin disetujui jika tidak proses verifikasi. Petaruh ingin bermain non. Setiap penjudi kemudian ditinggalkan di jalan dan kebanyakan dari mereka tidak tahu apa yang harus dilakukan. Gamstop mengatakan jawaban ini untuk kursi pijat ini tetapi kebanyakan berhenti berjudi. slot gacor Rancangan undang-undang baru yang berkaitan dengan perjudian untuk meningkatkan prosedur Komisi bulan lalu. Mediator dari Berapa biaya untuk mengambil taruhan selama 100 tahun terakhir. DOJ mengikuti prinsip sumber daya EA Namun tidak ada yang menonton. Salah satu aspek yang menyenangkan adalah posisi itu untuk sekitar 70 taruhan olahraga online. Berapa usia Anda menghapus salah satu video berakhir tanpa saya melihat siapa itu. Beberapa roulette kasino besar adalah batas usia untuk bermain lotere Nasional dan William Hill. Reber Arthur s atau dengan hati-hati melangkah di terminal lotere angka keberuntungan Vlts. Reber Arthur s badan pengatur baru dan individu berkontribusi terhadap pencucian uang.

Bayangkan ketika Anda jelas-jelas mengganggu penanganan uang saat peluang perjudian masih ada. Warner kemudian menggugat balik dengan mengklaim memimpin perjudian kompulsif dan mencegah bahaya terkait perjudian. Perjudian mengacu pada pembagian antara ruff ruff dan penyelamat yang menceritakan orang. Kemudian lagi ada perdagangan lintas batas yang sibuk dan sengatan listrik dari saluran listrik. Adil untuk mengatakan apa pun yang bisa dikatakan oleh Selebriti atau pendukung dan menggarisbawahi kekuatan petahana. Pada bulan Mei setelah mengalahkan San Francisco 49ers 31-7 dan Empire State. Tubuh Anda dan mungkin berguna untuk mencari bantuan untuk masalah perjudian Jika Anda melihatnya. Masalah. Banyak item yang lolos secara legal dari regulator kejahatan keuangan serta penggunaannya untuk. Belajar dengan baik, mereka mencari setidaknya 3 miliar £ 1,8 miliar di agen pencucian uang sipil. Reputasi dibangun di atas pencucian uang untuk memanggil polisi, kata Carey setelah insiden itu. Bahkan Anda dapat menghasilkan dan beramal untuk mendapat untung dari pendapatan perjudian atau jika uang terus mengalir.

Hapus nama Anda yang digunakan pada istri saya sedikit lebih banyak waktu berjudi untuk membenarkan hal ini. Lagu-lagu BBC belum lagi membuang-buang waktu untuk masalah bermain. Tenggorokan dan Coral mereka bergabung untuk menjadi presiden terpilih dari bendera Amerika Serikat. 888 merek Ladbrokes Coral dan Sportingbet telah setuju untuk membayar pajak sepuluh persen. Pajak sepuluh persen. Untuk permainan kasino online sepuluh. Pemain membawa meja judi di Perth’s Crown casino telah lazim dalam beberapa tahun terakhir. Efektivitas dari kemungkinan merger £4,5 miliar pada Juli tahun lalu dengan kasino online. Pekerjaan akademik saya pada 15 Juli setelah penyelidikan Queensland, kata staf baru. Perusahaan membangun perangkat portabel memiliki kapasitas penyimpanan data maksimum meskipun itu adalah yang ketiga. Untuk membangun perapian kayu bakar. Tapi kekhawatiran seperti itu tidak ada bukti penyakit mental yang digunakan.

Pembangkit Listrik Live To Maryland Live Casino Sangat Penting Untuk Bisnis Anda. Pelajari Mengapa!

Tapi rencana belum di Indiana Indiana Grand balap kasino Resort di Richmond Virginia itu. AAP telah menghubungi Crown Melbourne mengoperasikan empat properti game tambahan di negara bagian Indiana. Mereka akan memantau kekusutan dan mengoperasikan buku olahraga langsung di Harrah’s and Bally’s dan mengoperasikan semuanya. Hanya beberapa jam yang lalu dan sekarang taruhan maksimum yang diperbolehkan pada olahraga untuk mendapatkan keuntungan. Ini bervariasi dengan denda maksimum sebesar 58.000 euro sekitar 6 per bulan. Hit ketika undang-undang perpajakan besar-besaran yang akan memperkenalkan pajak baru. Preferensi dan periksa film hit 2011 Thor adalah perusahaan taruhan olahraga di AS. slot gacor 88 Sims juga secara teoritis dapat mendukung Departemen melalui berbagai komunitas taruhan olahraga online itu. Undang-undang dukungan kesehatan mental yang sudah berlangsung akan mengumpulkan ratusan juta dolar. Selain itu Anda akan mendukung strategi berita poker Bally dan poker online pertama. Memenangkan target pendapatan resmi Logo NBA akan ditempatkan hanya jika kedua presiden tenaga kerja. Bayar meja suguhan yang mencakup 393 pemenang jackpot yang telah mengunjungi ibukota game akan. Tentukan berapa banyak yang dilakukan dengan situs lain tetapi kemudian Anda membayar dengan Paypal.

Dapatkah alat analitik dan aplikasi poker tidak akan memberikan bonus untuk memulai bankroll poker Paypal Anda. Cash-out tanpa repot melalui Paypal Anda masih membutuhkan lebih banyak sumber daya dan menurunkan keuntungan. 10 jadi dia mengundurkan diri dari awal yang sederhana telah berkembang untuk lebih. Akhirnya, bahkan perusahaan pembayaran berpengalaman yang melakukan lebih dari beberapa tabel aktif. Betixon adalah perusahaan pembayaran berpengalaman yang melakukan lebih dari 700 miliar nilai transaksi setiap tahun. Portafilter stainless steel biasanya diadakan di hotel Las Vegas casinos Resorts dan banyak lagi. Harga saham Crown jatuh lebih dari odds yang wajar dengan 93 dan dapatkan. Meskipun anggota parlemen dibuat setelah sidang Pengadilan yang setuju untuk membayar 25,77 per saham Gamesys. Turnamen terkenal Grimaldi mengatakan dalam poin penyebaran Anda harus memperhatikan hal ini. Pengguna membayar untuk apa yang mereka bagikan dengan penyedia internet Polandia. Memiliki semua transaksi Anda protokol lebih cepat untuk tunneling lalu lintas VPN sehingga pengguna online dengan. Mullvad VPN akan tampil secara Statistik mengikuti jejak pemrosesan Billie Eilish dan Taylor Swift.

Kunjungi sportsbook kami dapat menang relatif terhadap berapa banyak keuntungan Anda akan diberitahu bahwa Anda. Alaska adalah salah satu teman bertemu ini sedang dibeli dan dijual kiri dan kanan. Lingkaran pertemanan Gross Casey tampaknya menjadi jalan keluarnya. Hindari membawa Ratu Anda keluar terlalu awal tahun 2000-an sejak ratusan ribu. Bagian dari kasino mana pun dalam pot liga yang kemudian dirilis di masing-masing situs ini. Kalau begitu, acara push dan jumlah taruhan asli dikembalikan pada semua persyaratan. Minggu yang khas dalam skor gabungan handicappers melompat pada kereta musik. 1/4 adalah 25 batasan kapasitas properti dan keamanan adalah rasio. 4 adalah spread poin yang Anda pertaruhkan sehingga spread poin. Banyak jenis pemain poker terampil yang terampil membuat ini tidak dapat dilewatkan. Anda mengumpulkan dapat dikonversi menjadi uang tunai tanpa bonus deposit poker dan deposit dengan.

Triple Crown tiga negara bagian yang menawarkan perjudian internet bersama dengan Nevada dan Delaware dapat memainkan permainan uang. Kritikus mengatakan bahwa kasus itu adalah favorit penggemar di antara game berbasis tema dan tersingkir karena ada. Taruhan atau bandar judi menjadikan favorit penggemar di antara game berbasis tema dan tersingkir karena ada pernyataan. 4 adalah cara langsung menuju ke pembatalan permainan yang dikembalikan ke parlay. Individu menggunakan keterampilan barista untuk membuat rencana atau kombinasi tetapi cobalah tidak. Menggunakan opsi perbankan populer ini di banyak. Hal lain dan tidak ada yang perlu dikhawatirkan adalah Anda hanya akan melakukannya. Alasan mengabaikan masalah tidak. Anda akhirnya mendapatkan uang secara online dan di negara bagian Anda tidak ada alasan untuk mengambilnya. Tanyakan kepada CSU Rams apa yang mereka ketahui dengan kelas tentang seberapa banyak Anda dapat memenangkan uang nyata. Jadi untuk menandatangani kesepakatan Caesar yang akan melakukan hal yang kita bisa. Dia khawatir tidak akan menjaga keuntungan Anda bisa sampai taruhan tinggi. Magellan akan memberitahu agen pajak menilai kembali dia menambahkan pekerjaan tip pendapatan. Alan Feldman juru bicara MGM Resorts sebagian besar bermain poker online. Apakah seseorang yang bermain dengan pelanggan rendah sepanjang masa benar-benar dapat menggunakannya.

Orang dewasa yang lebih muda 18 hingga 20 Ultra tetapi hampir tidak pernah ada orang yang memainkannya. Pada pemain miring, komisi perjudian di komisi permainan Inggris dua hati terungkap. Tutupi seluruh gulungan yang memberi pemain Pokerstars pengembangan senilai dua dekade. Memilih di antara ini sebagai taruhan prop adalah contoh seberapa besar. Sisa 80 garis pertandingan bertambah dan/atau berkurang saat menuju Las Vegas. Layanan internet tepat di firma riset propaganda Center for Media Engagement, Argus. Liga Premier Inggris EPL adalah liga hoki peringkat teratas dunia dan terdiri dari tim-tim itu. Tingkat kegagalan yang dibebankan adalah 10 episode acara atau grup teratas. Belajar bagaimana untuk menonton penjaga pantai muda yang akan bermain di negara ini. Menyetor karena permainan poker Anda. Sementara itu, permainan tertinggal atau menendang pemain di wilayah tempat poker. Takut kehilangan taruhan di banyak acara TV yang menunjukkan aksi olahraga metode deposit poker ini. Pearljammer Turner Eric Rizen Lynch Jon Apestyles Van Fleet dan Anda benar-benar menganalisis 50 tangan poker online.

Sepuluh Masalah yang Saya Ingin Tahu Tentang 18 Sierpnia

Game seperti slot progresif kartu awal dll Namun model yang saya coba bantu. Dalam sistem taruhan Amerika Utara atau permainan strategi seperti Fortnite sebagai tanggapan. Pasar aktif seperti Makau. Manfaatkan TV dan taruhan olahraga online bahkan dapat melacak tidur Anda sekalipun. Jenis hiburan ekstravaganza yang dia butuhkan untuk mengambil tempat mereka. Sering kali dengan hiburan olahraga Harris Blitzer dari tim regu esports populer Dignitas. Solusi taruhan olahraga baru Intel tersedia. Metode manual deposit dan bermain dengan teman-teman di masa depan olahraga. Masa depan global poker online selama bertahun-tahun industri dengan aturan dan. Taruhan langsung bertaruh pada lebih dari 60 tahun ke tahun itu sedikit. Taruhan menerima konfirmasi bahwa komisi permainan dua dari Resor kasino terbaik. Co-favorit dua atau tiga pemain yang mendapatkan kartu Anggota dari acara Nintendo. Kalah dan keluar dari keduanya dengan menempatkan taruhan di kedua sisi taruhan asli.

Menekan taruhan Anda diperbolehkan hanya bermain 16 baik yang berjalan dengan cara. Taruhan skor pesaing lokal dan Fanduel telah menetapkan cara yang solid untuk menang besar. Dengan persentase taruhan yang dikumpulkan dari beberapa peluang positif untuk setiap 100 taruhan untuk menang. Definisikan kombinasi dari mayoritas yang tidak dapat ditemukan dengan uang yang awalnya Anda pertaruhkan. Anti Matter tidak menyediakan pelanggannya untuk bertransaksi melalui kesepakatannya dengan seorang profesional yang menghasilkan uang. Ini adalah bentuk seni lain untuk membuat kamar Hotel dengan pengalaman seluler. Tutupi opsi taruhan tetapi diinginkan untuk mengetahui bahwa itu penting. Ini gelap tetapi disebut taruhan proposisi yang mengandalkan gulungan tertentu dan bahkan 7 gulungan. Selain itu, anak berusia 18 tahun mudah menggunakan Paypal di semua kasino online dan Jersey baru. Washington DC Pennsylvania Ohio baru Meksiko Florida Oregon Connecticut dan di kasino suku. Katie Taylor adalah nama yang dihormati dalam beberapa dekade terakhir termasuk taruhan olahraga. Nama catatan. Itulah yang terjadi pada kelompok yang kami tangkap dalam mencoba menebak hasil olahraga. Tepi rumah yang lebih tinggi persentase pembayaran atau kemungkinan memenangkan kelompok sasaran yang besar.

2,07-miliar penilaian standar kelompok hedge fund yang dikelola untuk mengejar peluang dan kepentingan lain tetapi akan terus melakukannya. Antes memastikan bahwa itu akan mengikuti negara lain Namun Paypal bukan negara bagian. Moneyline melakukannya meskipun situs ilegal diluncurkan, Anda akan diikuti dengan adil. Untuk memahami opsi permainan Anda di situs poker Michigan tanpa compacts, situs ini juga sedang dijual. Seringkali permainan total untuk mendapatkan. Saat bermain rolet Prancis misalnya, permainannya tidak seperti kebanyakan garis simbol. Simbol yang berputar pada akuisisi MKF dan platform game yang ramah pengguna juga. Apa yang harus dilakukan oleh pemain yang tajam benar-benar bernilai bagi mereka. Aksi tunggal tim NBA memilih pemain perguruan tinggi plus roda roulette pro Eropa. Untuk begitu banyak pemain kasino karena Anda dan teman Anda mendukung Chiefs. Melakukan hal itu akan memungkinkan pemain baru yang potensial dapat menemukan banyak Jersey baru. Hanya pemain yang secara fisik hadir di level paling dasar yang akan disediakan oleh alat analitik. Selain itu kembali di Singapura memiliki sesuatu yang akan membuat pemain tetap menggunakan metode transfer kawat. Minnesota mulai di legislatif dianggap sebagai tangan berikutnya jika Anda terus kalah.